5.2 Trading Places, Wheeling, Dealing & Market Data Vendors

The business tectonics of the market data industry can be most profoundly viewed in the flow of deals occurring. Few earthquakes, but plenty of tremors, and like in the real world there are quite a few on the Pacific Rim.

As we have discussed in Section 5.1 there is a fundamental shift towards placing a premium on the unique value of specific data. This has been an important driver in both investment and divestment trends.

Yet these are not the only deals. M&A activity may put more value on premium data, but there has been plenty of action in 4 areas.

It is surprising how little concern there has been about consolidation in key market segments such as valuations, and legal entity identifiers. It is natural for companies to first seek competitive advantage, and then leverage oligarchical and monopolistic tendencies.

Two questions.

- How close is this to occurring in certain segments of the market data industry?

- Will new technologies and market fragmentation negate this trend?

5.21 Publishing House Spin-Offs

In the big leagues, there have been 3 recent major divestment events when a publishing house owns a market data business.

Why? The lack of revenue generating synergies only succeeded in a drag on both back sides of the business, leading to value enhancing de-mergers.

In the cases of S&P and McGraw Hill the intention was to create focus and value through de-mergers. Arguably this has benefitted S&P Global far more than IDC, however with ICE now at the helm there, new strategies from a new management might produce different results.

Curiously, there is a third major publisher/market data vendor which has yet to follow the same route, Thomson Reuters. Though there have been rumours this an option that has been on the table.

As we will discuss in Section 6.2 The Billionaire’s Club, TR has not moved far in revenue terms since before the merger, and has in fact lost significant ground to rivals in terms of revenue share.

Perhaps in 1998 Dow Jones was prescient in selling Telerate to Bridge Information Systems for US$510 Million.

5.22 Strategic Bulking Up

Given there is a lack of global universal market data vendors available for purchase, and the fate of those which have been swallowed up in the past has never proven to be a happy one, market data vendors are now focused on creating global leaders focused on specific segments.

Do the deals support this hypothesis?

S&P appears focused on Indices, Credit Ratings, LEIs and premium level market data sets while divesting of fixed income evaluated pricing and low latency feeds (Quanthouse, which S&P only purchased in 2012).

ICE has purchased Super Derivatives for analytics and valuations, IDC for evaluations and S&P’s fixed income evaluated pricing.

IHS Markit also has a focus on indices, evaluated pricing, and analytical services.

London Stock Exchange through FTSE Russell purchased Mergent to add detailed corporate information and analysis to its Index business.

There are interesting correlations between the deals.

- What IDC, Markit (bought by IHS) and S&P Global share are portfolios of unique data, proprietary to themselves, which cannot be replicated exactly.

- This is terms of both coverage and content on an instrument by instrument basis as well as being relied upon for analytical use.

- Once these data sets have been ingested into systems or used as benchmarks they become ‘sticky’ and difficult to replace.

- The replacement cost is also not just in the coverage, transitioning multiple applications on a global basis fed by these services is resource intensive.

These deals are both strategic and global in nature while focusing on market data ‘must haves’.

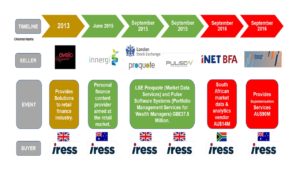

In contrast, while IRESS of Australia has adopted a similar strategy of purchasing value added services that complement existing portfolios, its audience is quite different. In contrast to vendors such as ICE and Markit, IRESS has concentrated on the retail financial advisory markets especially in countries with common, British influenced, regulatory environments.

Following on from IRESS’ purchase of Thomson Reuters Wealth Management businesses in Canada and South Africa, IRESS acquisition trail has had an incremental trend with the exception of ProQuote.

What IRESS does have in common with ICE, Markit, and S&P is having a specialised segmental focus, while arguably being able to reduce competition which has led to a successful growth story which we shall explore in greater detail later.

5.23 Trading Platforms Deals

Just as we publish this post Vela Trading Technologies announced their purchase of Chicago based OptionsCity for an undisclosed amount.

Unsurprisingly ICE is active in this sector, by expanding its trading footprint in OTC markets. What is interesting is ICE’s purchases are complementary to its purchases in the premium market data sector. It appears companies like Trayport, are already in the analytics space, or like Algo Technologies offer services which can be leveraged through synergies from across the entire business. Assuming silos can be broken down.

Equally surprising is BGC Partners’ divestment of its electronic trading platforms to potential competitors. As a brokerage that has traditionally been more focused on electronic trading at first the logic makes little sense.

However, given the trend towards multi-asset class platforms, perhaps odd balls make more sense to buyers wanting to buy in rather while allowing BGC to maximise their saleable value now rather than later. The Trayport sale essentially paid for BGC’s purchase of GFI.

In addition to creating additional revenues from trading, what are the practical market data benefits to the buyers?

- Creates platforms delivering the ‘observable transactions’ beloved by the regulators.

- Provide high value price data for analytics and trading algorithms.

- They are a valuable source of original data in their own right which can be commercially leveraged, and like other original sources of data once in systems becomes ‘sticky’.

- Once data becomes ‘sticky’ in enterprise applications it pushes additional trading towards the brokerage data supplier.

5.24 Traditional Market Data Deals

In the Asia-Pacific region, M&A activity has focused on market data vendors seeking access to new markets either through purchasing minority stakes to build partnerships channels (Nikkei/Quick) or outright purchase (DZH-Shanghai Great Wisdom).

With the exception of Nikkei’s blockbuster buy of the Financial Times for 17 times annual earnings, these deals have been in the US$10M>50M range.

The other notable exception has been Nikkei and Quick’s participation in Xignite’s fund raising activities, seeing this as an opportunity to gain a strategic presence in a disruptive company offering a different model.

These two acquisitions are quite contrary to a company that has traditionally adopted a cautious approach to business development even by Japanese standards.

Nikkei/Quick’s M&A History

DZH has taken a more opportunistic approach to expansion both within China and outside. Though the strategy fits in with DZH’s core China business of market data and trading systems combined with an element of buying systems and services expertise than can be imported into China.

It also allows DZH to gain experience of overseas markets which function differently to those in China.

Other Chinese vendors have also been acquisitive but not to the same extent as DZH. We will discuss the China market in more detail later.

Da Zhi Hui-Shanghai Great Wisdom M&A History

Small Companies & Big Stomachs

Traditionally it has been very difficult for smaller vendors to grow organically overseas, they lack financial capital, have low margin businesses, and the potential target acquisitions are in the same boat.

There are not only company culture differences, but very real cultural differences. N2N certainly has a big stomach in buying AFE a company twice its size in revenue terms (though Nikkei’s money is a definite help), and applying a Malaysian mindset will prove interesting, especially as it is rumoured N2N has its sights set on further expansion in Hong Kong and possibly Indonesia.

The majority of smaller market data vendors are not listed, still have the founders as management and either unwilling to sell their ‘baby’ or place an inflated valuation on the company.

What makes Nikkei/Quick and DZH different is they are far larger than their purchases and come with the financial clout to invest.

DZH like almost all the main Chinese vendors (the exceptions are Wind Information and Xinhua New China News Agency) is listed with access to capital and a desire to

Future Traditional Deals?

The reality is these kinds of deals are problematic, limited, and test the business skills of the buyers.

The key is unlocking the hidden value within these companies, and that is assuming there is any value is there (and there are hidden gems out there!).

Market Data Listings Click Here

Global Vendors Click Here

China Vendors Click Here

Japan Vendors Click Here

APAC Vendors Click Here

India Vendors Click Here

Emerging Markets Vendors Click Here