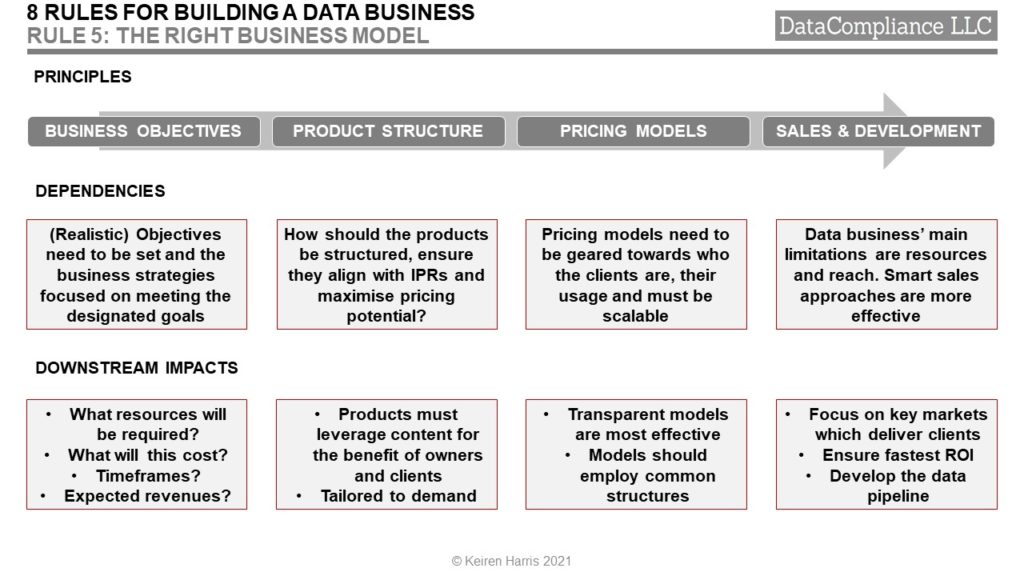

Rule 5 Objective: Establish business parameters that maximise revenue by developing strategies appropriate for your datasets matched to the potential market

Why? The wheel has been invented with many versions, some work, some do not (e.g. the square ones). In reality, most new business and pricing models are variations of older models adapted to meet new circumstances, development of a new market or market framework.

But those that do work, do so for good reasons. Often these are specific to a particular market or environment at an advantageous moment in time. The business must account for the peculiar nature of data as a commodity, its utility, and very much the evolution of data itself and the revolution of what is happening to data in the marketplace.

There are advantages to understanding what drives the market and why to examine if they can be applied to your own circumstances. Google has developed a strategy of providing analytics for free to enable their advertisers to target audiences more effectively in return for advertising revenue. It works exceptionally well, but is this model right for others?

The Key factors are:

• Each business is unique and copying others blindly rarely delivers like the original

• However, each business model does share successful principles

• There are reasons why some models work and some do not

• This can be due to multiple factors, i.e. a lack of understanding of market dynamics, poor application of the preferred strategy, often the wrong people to put it into practice

• A good example is the Bloomberg fixation, a highly successful model which others have failed to make work for them, however models need to change and adapt as the market evolves. Followers rarely make good leaders

• Too often new products fail because the business model is wrong for their target market

• The business strategy must be easy to understand, transparent, then apply

• Available resources are a major limitation, this means leveraging partnerships

Four core strategies to be adopted:

Rule 5 Future Development

The business and price models must be structured around data consumption and usage, this will be far more effective in keeping them up to date, relevant to the data consumer, and enhance revenues. It is important to develop the data business by adding new content and coverage to broaden and deepen the data experience.

Learn from others, for instance many exchanges data businesses have hit saturation point, this is usually when data ‘sales’ reach 10% of total revenues, because those who must have their data, do have it. This is when value added data and services kick in. It is no accident the largest exchanges, like ICE, LSE, NASDAQ, and SGX have diversified into analytics, indices and investment decision tools increasing their data service related revenues, while others like HKEx underperform.

How?

• Ensure the business model is underpinned by best practice IPRs (Rule 1)

• Simple straightforward business and pricing models generate higher returns than complex models •Base the business model around data usage, leverage the ‘Snickers Effect’ for maximum yield

• Avoid cannibalising your own business. Unless you have a captive market like indices (FTSE Russell, MSCI, S&P), unique data (IHS Markit, LSE SEDOLs) or embedded audience (Bloomberg), it is extremely difficult to raise prices

• Price lists should be public and transparent, avoid subjective sales and deals, they tend to come back and bite later

• Not all sales are good business, there is a difference and in data a bad sale usually has long term consequences because of the length of contracts

• Yes, there can be too much existing data, so broaden the experience and add value to the proposition

Getting Rule 5 right delivers maximum revenues

Rules 6 to 8 to come!

Keiren Harris 18/03/2021

Please email knharris@marketdata.guru for a pdf or information about out consulting services