It’s a Mad, Mad, Mad, Mad World

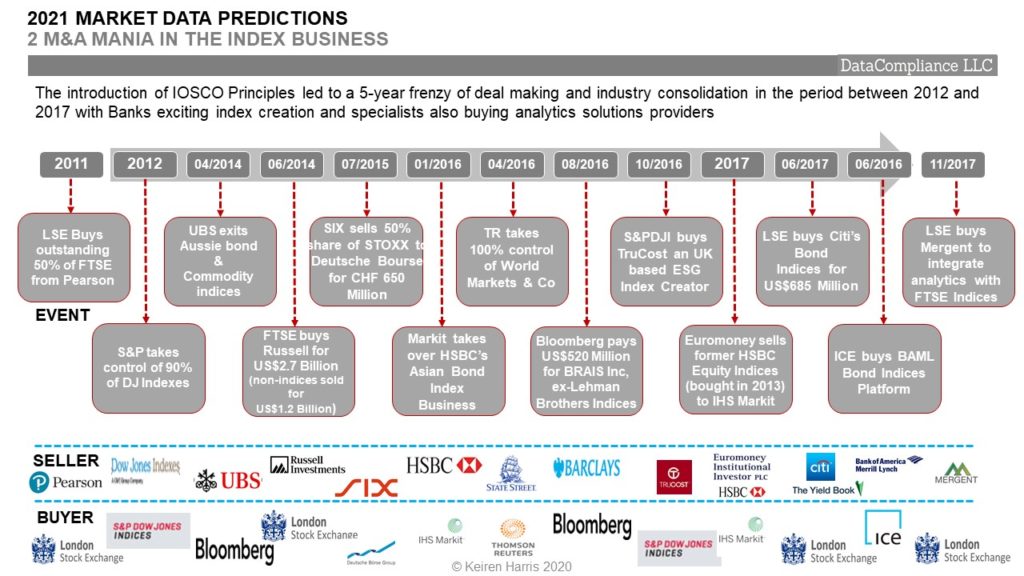

In my 5 predictions for what will happen in the market data world for 2021, (www.marketdata.guru/2021/01/05/2021-market-data-predictions-5-crystal-balls) my second was to assert that the S&P Global/IHS Markit mega-merger will start a trend of data players seeking entry to the market data industry via purchasing high grade digital assets built around original works (indices and benchmarks) and decision making tools (analytics).

This asset scramble could well attract large outsiders like Google, Amazon, and Comcast, challenging existing players and exchanges such as Moody’s, MSCI, the Chicago Mercantile Exchange, all with deep pockets, for a competitive edge by buying out mid-range companies with unique presence, i.e. Factset, Morningstar, Rimes, along with IP driven specialists

And to look out for a Bloomberg blockbuster

Mega-deals don’t come along very often, yet they do create a ripple effect as interest gets generated, however, the data industry is surprisingly active in M&A.

2021’s question is what specific areas are likely to be of interest and why?

On the Hunt

Given the existing levels of saturation, market emphasis switches to differentiation, availability of original data backed by market depth and history, utilising analytics crafting the ability to manipulate data using investment decision tools. Subsequent performance then needs to be benchmarked.

So, which 5 areas grab our particular attention?

- Technology. This subject area is just too broad, so we will focus on certain specific areas which will attract interest. Firstly, data publishing, this is usually an after-thought but market fragmentation with new alternative channels to clients means this is becoming more important. An important feature is to be truly ‘Cloud native’, there is too much ‘I am in the Cloud’ which means nothing more than being hosted on AWS. This is also attractive because it helps lock in original data content.

Secondly, Risk and Compliance software especially for the OTC markets which have their unique idiosyncrasies driven by the need for greater transparency.

Thirdly, Reporting technology as new regulations like FRTB, increased use of sanctions, and a requirement for market transparency. 2021 M&A activity in technology will focus on specialist lightweight tech operating in the Cloud designed for future development

2. WealthTech. Perhaps this should be part of technology, but the reason it is not is because it is a dynamic sector now coming into its own as banks ditch legacy in-house developed systems for third party platforms which also offer data processing as a service reducing costs and effort for the banks.

This comes at a time when the HNWI market is expanding rapidly, especially in Asia, requiring far more data and resources than previously. This has attracted significant Private Equity and Venture Capital into Wealthtech businesses to the tune of tens of millions. Vendors like IRESS has built up a strong wealthtech portfolio, and 2021 will see other vendors following them into this new and expanding frontier

3. Indices & Benchmarks. While the strongest demand is for index businesses, it now has the weakest supply, as FTSE Russell, and S&P Global, along with vendors such as Bloomberg and Refinitiv throughout the 2010s been hovering up independent index creators and buying out financial institutions’ OTC indices. This has increased the value of the smaller specialists, like Solactive which recently raised €60M in fund raising, and SGX’s purchase of Scientific Beta for €186M.

So do not expect much to happen in 2021 in this area, with the possible exception of Morningstar with its index and credit rating businesses,, though independents could find it relatively easier to raise capital if they have a good story to tell.

One potentially interesting deal would be a marriage of MSCI’s index and analytics business with Moody’s credit ratings and research services. While it would be an intriguing match of cultures, they could feel caught out in a no man’s land between juggernauts like ICE, LSE/Refintiv, S&P Global, and smaller players.

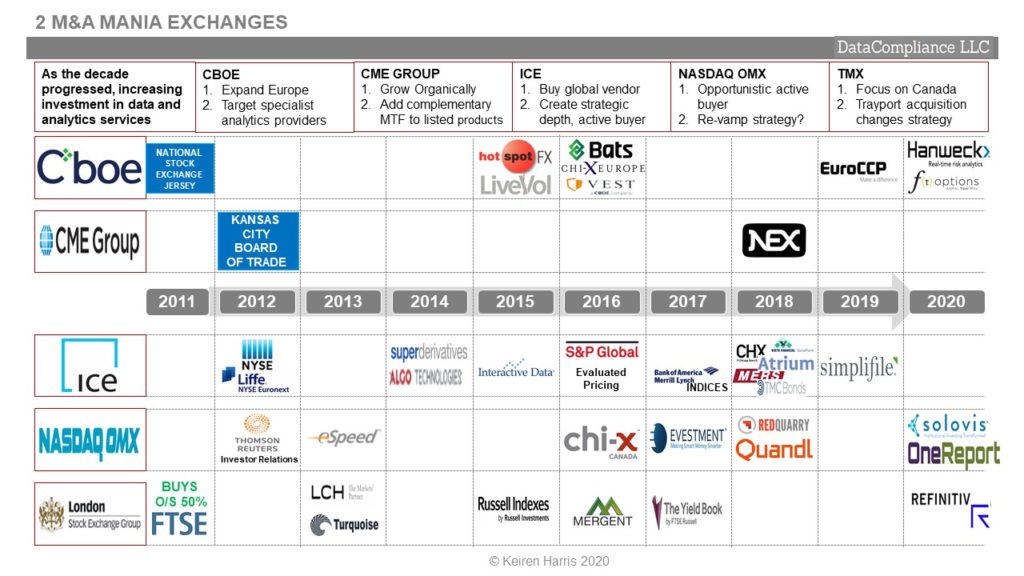

4. Analytics. Again, during the 2010s an active M&A area, primarily for exchanges like CBOE, ICE, LSE and NASDAQ to add value to their underlying data services, but also for the vendors as well, like Refinitiv (and antecedent Thomson Reuters).

Many exchanges have yet to make a move in analytics, yet they are definitely considering it, with the proviso that the assets on the table are relatively inexpensive because the smaller exchanges data businesses are caught in a ‘chicken & egg’ situation where their existing data businesses have reached revenue plateaus, and to develop further requires value added services like analytics which cost. There are interesting analytics providers out there which are available, especially in the OTC space, and 2021 could be the year for multiple, though smaller, deals involving analytics providers

5. Electronic Trading Venues & Platforms. This is all about OTC market data plays, as well as gaining a foothold in the liquid OTC space. So far deals have focused on the liquid end of 2 asset classes, Bonds (MarketAxess/LiquidityEdge US$150M, TP ICAP/LiquidNet US$700M) and FX (CBOE/Hotspot, Deutsche Börse/360T, Euronext/FastmatchFX, LSE/Refinitiv).

Yet there are a plethora of IDBs and venues that specialise in equity derivatives, interest rates, commodities trading, and energy markets that have built solid businesses around trading platforms, but not exploited their data assets. In 2021 this represents opportunities to acquire presence in key markets and leverage data to generate new, additional, revenue flows

Incentives

Many existing market data businesses have reached the end of their current natural cycles and need to develop longer term strategies not only to take their businesses forward, but because the marketplace and client demand is changing rapidly.

• It is quicker to buy market share than build from scratch, i.e. revenue now not later

• It is pointless to continually ‘re-invent the wheel’

• To build internally is costly in terms of investment in infrastructure

• Expensive to find and hire the requisite expertise

• Blocks the competition

Challenges

Unfortunately, too much M&A in the data space has resulted in value destruction, it is hard to escape Refinitiv’s track record, or is more opportunist than strategic, like NASDAQ and CBOE

• Finding the right partners takes time and effort

• Many quality businesses have already had their dance cards marked

• Demand exceeds supply in areas like indices and electronic venues

• Integrating new partners can cost more than the purchase price

• Ensuring there is clear strategic vision to maximise the value of the purchase

Summary

One area I have deliberately avoided is digital assets. While 2021 could well be an banner year for crypto-data M&A activity, certainly in trading platforms and venues, it is hard to ignore its appeal to, let’s say ‘dodgy characters’.

In assessing the 5 different topics, the common thread is that it is easier to enter each segment through acquisition than build organically.

The fastest, and most obvious answer is to buy success, and 2021 could shape up to be an active year indeed, though there will be 3 driving factors:

- The supply and demand equation

- Quality of the assets

- Market share of the target assets

It will be interesting to review what happens in 2021 at the end of the year

Keiren Harris 15/01/2021

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf or information about out consulting services