DISSECTING THE DEAL, IT’S ALL ABOUT DATA IP

Behemoth the Sea Monster will never go down as a British classic film, however, the S&P Global/IHS Markit merger (if it goes ahead) will prove a seminal deal in the data business. It has all the makings of being a classic about squeezing money out of data ownership and maximising IP rights.

The more a data business can generate its own IP, and the less it relies upon third party data owners, the greater it controls not only its business destiny but the fees that can be charged, and in data that means being re-charged ad infinitum

Providing straight data has its limitations, there is only so much data, and there are only so many clients willing to pay top dollar. Creating value out of the underlying data for use in analytics, investment decision tools, developing new original works like benchmark, indices, derived financial benchmarks frees data from these restraints. But importantly brings into play factors which drive up the value of the data.

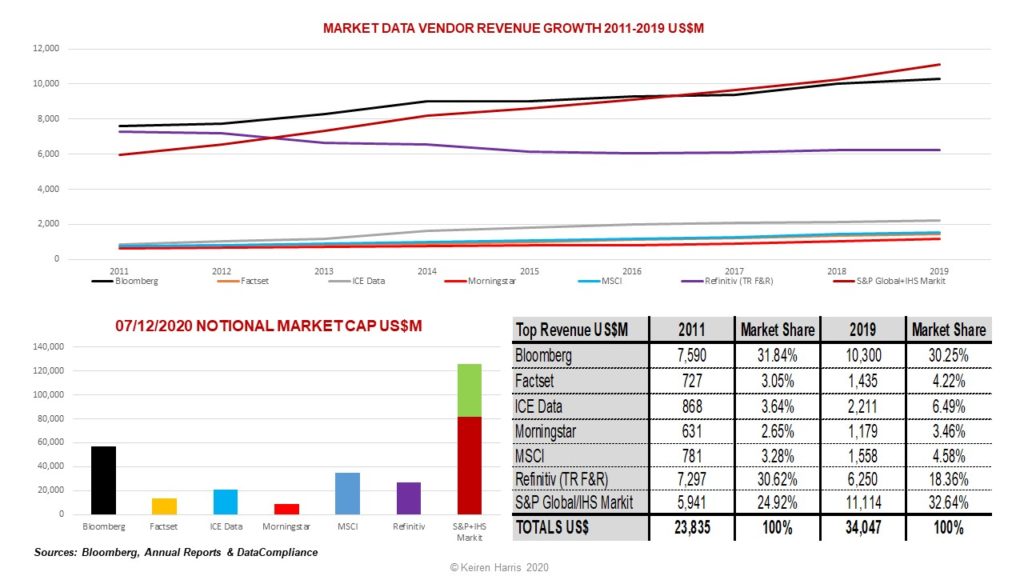

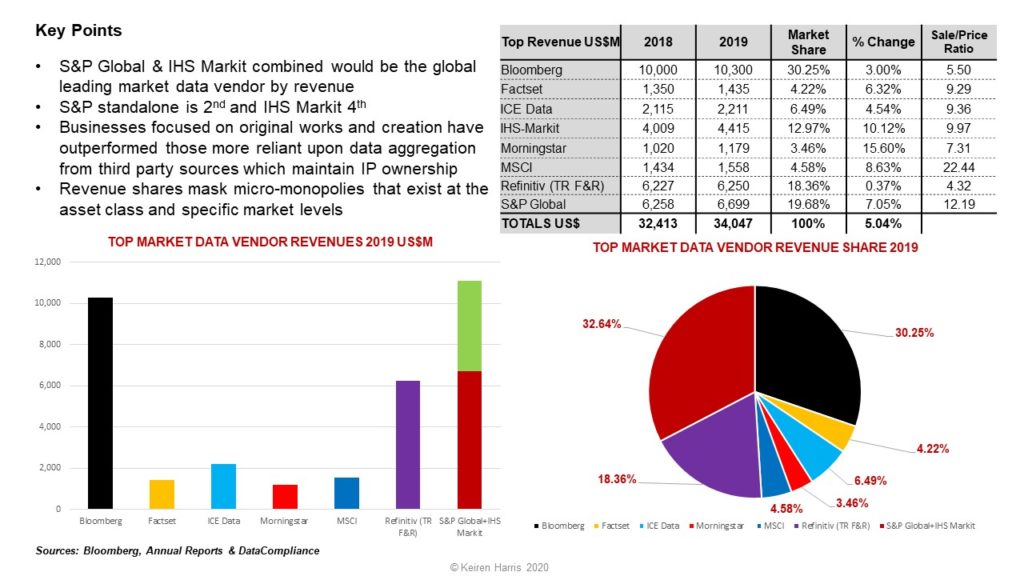

Contrast Refinitiv a similar sized company in revenue terms to S&P, but geared towards data aggregation, was sold to the London Stock Exchange Group for US$27 Billion, whereas S&P with triple the market cap (US$81.7 Billion) valued the smaller IHS Markit at US$44 Billion

IHS has a more diverse range of businesses, to a great extent S&P is overwhelmingly about big brand indices and credit ratings. Until now it has lacked the depth of analytics that MSCI has brought to indices, or Moody’s to ratings.

IP FUNDAMENTALS

So, if data IP is so important, what does IHS Markit bring to the S&P party?

- Not exactly highlighted but IHS Markit’s Credit Market data is a micro-monopoly in itself. Widest and deepest coverage of the market which will feed significantly into both S&P’s index and credit ratings business

- Combining S&P and IHS ESG businesses will cement a stronger position not only on the benchmark side but equally by locking in the corporate side of the market. ESG is a new fundamental

- The iBOXX indices bulk up S&P’s fixed income suite, the bond index market has not really had a true leader, yet

- Opens the door to a significant presence in the post trade market via Markit’s (not exactly liked) RED (Reference Entity Data) codes, valuations, and post trade processing. In turn this generates data that is re-sold back into the market

- Analytics. IHS Markit has specialised in taking proprietary data (and charging for it) then providing an analysis of that data (and charging for it again) to an art form. Applied to S&P’s existing business this is a definite force multiplier

- The most intriguing area of all, IHS’ own information business, a veritable cornucopia of commercial and alternative data that is still waiting to be exploited because the business and pricing models appropriate to the data have yet to be applied

COMPETITIVE PERSPECTIVE

This deal confirms my longstanding mantra that the potent mix of owning data IP combined with value added data creating analytics, indices, and benchmarks, leads to the highest market values (and fees), with the greatest appeal to investors

The Beast Hits Town

If I were a competitor or a data consumer, the existing overlap between S&P and IHS would not worry me so much as the potential business synergies gained by enabling S&P IHS (or whatever it is to be called) to lock in clients across vital business areas outside the indices and ratings areas, for instance post trade services feeding off common analytics services

The ability of IHS Markit to cross-pollinate revenue generating services across what seems to be unconnected and/or disparate datasets was a design feature of their New York office (Bloomberg’s too), and is fascinating to watch in action. If S&P can transition this capability on a larger scale, then S&P IHS will prove to be formidable beast

When analysed the market data vendors have less in common together than competitors in most other industries because of the multiple levels of data differentiation, which is exacerbated by the coalescing of data monopolies, or at best oligopolies in key business areas, indices, ratings, valuations, and analytics

• Major data aggregators like Bloomberg and Refinitiv will be impacted by this merger but not immediately to the scale of companies like Factset and Morningstar focused on the analytical space, exchanges yet to build out value added business services, or companies transitioning from being data providers to data processors and data facilitators

• Regulators have yet to reveal they fully understand the mechanics of how market data functions in financial markets on anything less than a macro level, and this merger is definitely about workflows

• For the financial institutions the merger brings together 2 monopolistic entities that are already next to impossible to remove from key sections of the business, because of the uniqueness of their data and/or IP

The winners? Shareholders and owners of data/IP driven businesses putting their assets to work, like S&P Global and IHS Markit

Keiren Harris 07/12/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf or information about out consulting services