What does Thanksgiving and Data Compliance have in Common?

Easy, absolutely nothing. Thanksgiving is that uniquely American celebration, while data compliance is a global problem involving huge costs focused on financial services.

The only really commonality is something, someone, somewhere, gets stuffed, put on a plate and carved up.

And it is this time of year the data owners, exchanges, brokers, vendors, index creators, plan their turkey audit programme for next year. Without data financial institutions cannot function, and data is a multi-billion dollar, for instance, the top vendors, exchanges and index creators estimated revenues from data services exceed US$43 Billion pa, www.marketdata.guru

Data has ownership, if it has a value then the owners want and should attempt to exploit it, then protect it.

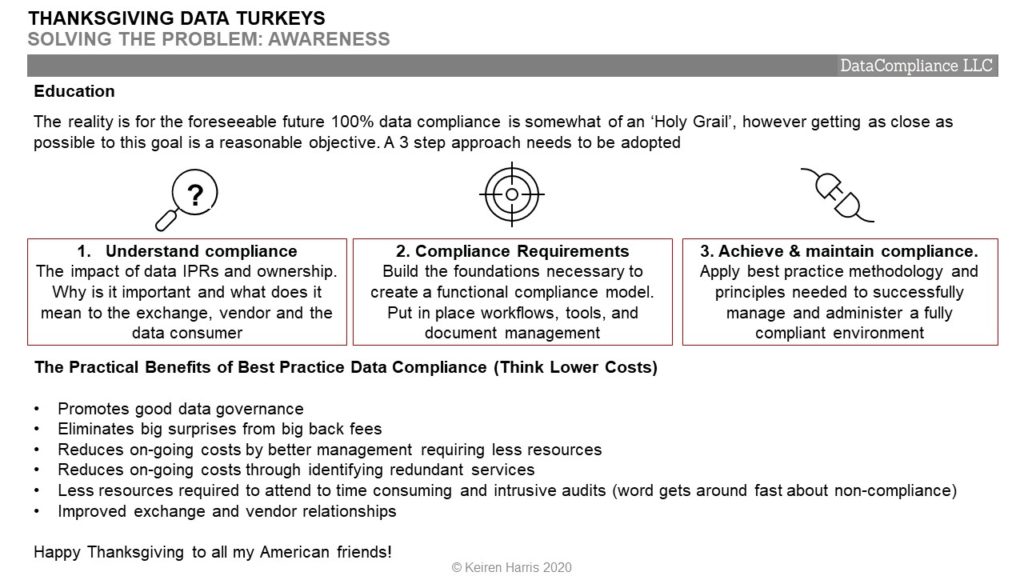

The problem? Compliance is hard work, there must be the right systems in place to:

- Control access,

- Monitor usage, and

- Report on both using a fully automated audit trail (Honesty statements are quite laughable)

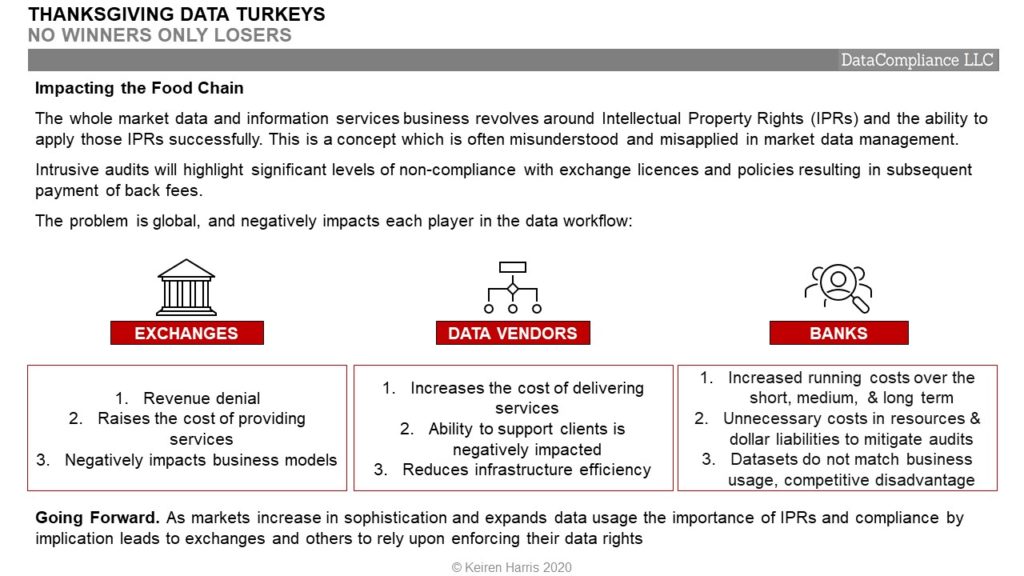

This is as much about effective data governance and processes as it is about tools in place (ignoring a willingness, or lack of, to be compliant), and non-compliance comes with a definitely not free-of-charge large dollar invoice

What happens when a bank is thought to be non-compliant? The auditors come to visit.

The Cost of Non-Compliance

When a bank, broker, financial institution, or other data user is non-compliant it costs, big time.

In my own business where we have conducted audits and audit defences, the average liabilities paid by 17 institutions (the found figures were always higher) was US$4 Million per audit, and this is a small amount compared to the eight figure sums Tier 1 institutions are known to have paid out over recent years.

Prices to be Paid

When found non-compliant, the data owner is going to demand payment for the period of the audit, for exchanges the standard practice is either 36 or 60 months, while index creators like MSCI do start from the very beginning of the non-compliance (10+ years for one bank added up significantly)

The days of negotiating down the final liability findings are finally coming to an end, rewarding systemic failure by reducing the final bill is simply not acceptable. Why?

• It is grossly unfair to those institutions that work hard to be compliant

• It confers an unfair competitive advantage as non-compliant entities can compete better on margin

• Regulators are beginning to turn their attention to non-compliance on the basis that if an institution is being naughty in one area it is highly likely there are problems in other areas

In the end non-compliance hurts everyone

Keiren Harris 25/11/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf