Apocalypse Rising?

The metaphors and allegories used in this series of short articles are well worn, somewhat clichéd, and been applied to this and many other subjects many times before. However as our allegorical meteor comes ever closer to impact, now is a good time to re-assess the implications on the market data vendors from a fresh perspective.

The market data vendors are big businesses with the Top 10 vendors earning US$34.8 Billion revenues in 2019 (Please see https://lnkd.in/fwyVS8x). The market is high margin for the leaders, it is growing, and the icing on the cake is there are larger markets out there relatively untapped. We live in an age of change, and this business is one of the most dynamic and revolutionary around.

In a series of 3 articles we examine the existing challenges faced by market vendors and where new enlightened data players are beginning to take advantage of the structural change in the market data business area. At the moment it is being driven by technology, the displacement of heavy tech with its high upfront establishment fees and then ongoing costs with lightweight tech, along with a focus that has shifted from data quantity to data quality, Intellectual Property Rights (IP), and analytics.

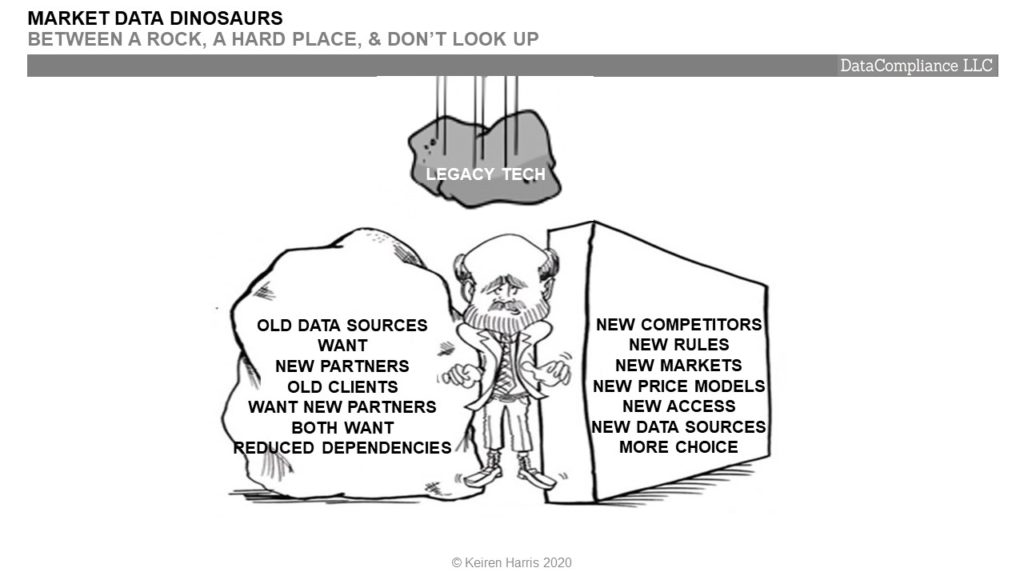

This first article looks at market data vendors caught between changing relationships with data sources, the breakdown in traditional client relationships, and incarceration within the prison of legacy technology.

The second examines the impact of changes in the market data business, while the third takes a cautious look at which vendors have the tools to thrive in a new world.

THE DATA SOURCE ROCK

Data Sources Want New Partners

Market Data Vendors face 2 immediate problems in their on-going relationships with the major souces of data vendors use to create their products and services. Firstly sources, like exchanges, IDBs, Banks, recognise their over-reliant upon the vendors, and secondly, new sources do not necessarily see why they have to become dependent upon the vendors to reach clients in the first place.

- Revenue Sharing. Typically an individual exchange and the Inter-dealer Brokers receive 60%+ of their market data revenues from/via just 2 vendors, Bloomberg and Refinitiv. These data sources want to reduce their reliance upon the vendors, find new channels and partners, partly to mitigate risk exposure, but also because the vendors are increasingly competitors, too often poor in reporting data usage, while creating products and services from which they derive no benefit

- Pay You, Pay Me. The vendors are accustomed to paying for data from primary sources like exchanges, and receiving for free bank contributed prices (then claim IP over this data), but now these vendors are turning away new sources through disinterest or wanting these new sources to pay the vendors to distribute. These new sources are the ones being sought by Hedge Funds and others

Clients Want New Partners

In contrast, Banks are looking into a different mirror to the data sources

- One Universe or Multiverse? Like the data sources, Banks themselves seek to redress the imbalance caused by over-reliance especially on Bloomberg and Refinitiv. However, no other vendor has been able to replicate or resource the extensive universe of data that each of these two vendors can provide. Yet new accessibility, data malls and alternative sources will eventually negate the one channel for all existing advantage of major vendors

- Content or Content Provider? Even in the future for many, the vendors’ consolidated feeds are the only cost effective and/or practical option to source data for business. Especially for the important OTC markets with their kaleidoscope of contributors’ prices, whose quality range from high to dubious. With the increased need to know the content source along with the quality of data provided, the requirement for direct relationships contractually and usage subverts existing vendor relationships

THE CLIENT HARD PLACE

On the hard place side, the potential challenges are on the one side becoming clearer, yet in other places, not so apparent

- New Competitors. Few now seek to challenge the traditional vendors head on, there is little point, so the threats are new and from new places, on the one side, the development of data malls, which do not aggregate data, but act as a business conduit, and on the second the growth of cloud environments allowing direct connectivity with the cloud providers themselves providing the competition

- New Rules. Quandl, Tradition, Xignite and others have all attempted new models, with little success, partly because they try to work within the rules. However FinTechs lacking traditional relationships, or line of sight with their data suppliers, often lack the reticence to ignore IP, and in other industries like music actively sought to disrupt. In the more regulated financial markets this will prove more difficult, but the democratisation of data markets is a real consideration

- New Markets. The growth in data use outside saturated core financial institutions, by retail investors, HNWI, small fintech (especially Wealthtec), and mass media has only just started to manifest. The vendors business strategies, price models and fee levels are not fit for purpose to adjust to different environments other than financial institutions

- New Price Models. Pricing models need to adapt to compete with FinTechs and Data Malls which are better able to tailor pricing to actual usage, and for mass markets completely change the parameters of defining what usage is

- New Access. The Cloud and internet using better security has reduced the need for direct infrastructure, the new levels of accessibility enables smaller vendors to compete globally, new data sources to circumvent the vendors, reduce costs of service, and allow those with lower costs to compete on margin. Ryanair meets Air France in the datasphere

- New Data Sources. The number of sources which have successfully built commercial data businesses is just a fraction of what can be made available. This shrinks the current ‘universality’ of the big vendors

- More Choice. New markets, greater competition, usage driven price models, more data sources distributing via a greater array of channels leads to more choice and greater disintermediation of traditional market data vendors

DON’T LOOK UP, LEGACY TECH

Reliance upon legacy tech is a problem for the vendors that supply then support it, and the clients that use it. It acts like a prison for both because of its complexity, cost, and ability for competitors to steal advantages because they can upgrade their tech faster, cheaper, as well as keep updating it faster and cheaper.

- A Classic Case. Refinitiv’s TREP which has locked the big financial institutions into a solid vice dependent upon the spider’s web of inter-connectivity between applications which host Refinitiv data. Very hard to move, but the big institutions are out for reducing costs, and again industry growth is coming from areas, businesses and institutions which are not locked into TREP like environments.

- Spotting the Problem. TREP is so obvious because it is onsite for clients, so the issues tend to be front and centre, whereas Bloomberg’s and other vendors maintain their infrastructure offsite. So while many of the same dependencies and issues remain, they are just not so transparent.

- Data in the Dark. What was once a datafeed utility allowing banks to distribute, share, and add value right the way across the business, is now a mass of unknown dataflows with undetermined interactions, where changes in one area have unintended consequences elsewhere. Trying to disentangle this Gordian Knot requires a superhuman Alexander the Great.

- Clogging the System. The big financial institutions were naturally early proponents of datafeeds, however this market space is now saturated. Below the larger institutions the medium sized Banks and the larger retail market have yet to reach these levels, with the cost of traditional infrastructure and data being a major disincentive to invest heavily.

- Outside the Shackles. This leaves these institutions free to leverage opportunities generated by new providers, new sources, as well as existing sources, distributing information utilising new technologies, delivered now by ‘The Cloud’.

Once the cost of infrastructure acted as a barrier to entry, now it is barrier to innovation and evolution

BETWEEN A ROCK, A HARD PLACE, & DON’T LOOK UP

Summary

The reality is the market data vendors are being pressured from several angles, and while the sources vary, the issues are very much inter-linked in terms of relationships. For instance:

- Partnerships and relationships are changing, the preference is for direct relationships across the workflow. These flows are no longer linear, they have become multi-directional where suppliers are feeding consumers, who in turn are data suppliers in their own right

- New workflows are being driven by new types of consumer, often fintech driven, such as external third party processors utilising automated solutions which have displaced inhouse applications of Banks which now just want data outputs without the encumbrance of managing or processing the data themselves. With new markets, new types of consumers, new ways of processing data, changes in the competitive landscape the demand to interact technically, and contractually in different ways, requiring alternative pricing models better structured to their type of usage instead of using models more suited to financial institutions.

- The problems of legacy infrastructure are multiple, but the major issue is one that gets least exposure. The lack of documentation, everything from the versions, capabilities, to a lack of knowledge of where data is actually flowing to and from. The entry points are well known, but after that, call Captain Cook. This means changes down to as simple as altering a price ticker can have devasting effects elsewhere in the business. The business risk of change can well outweigh the cost benefits, or the competitive disadvantages. It means adopting new tech must take a careful measured approach

Evolving to meet each of these parallel challenges needs a smart strategy, might need a major advance in real AI.

Keiren Harris 19/10/2020

www.datacompliancellc.com

Please email knharris@marketdata.guru for a pdf