Different Vendors, Different Revenue Models

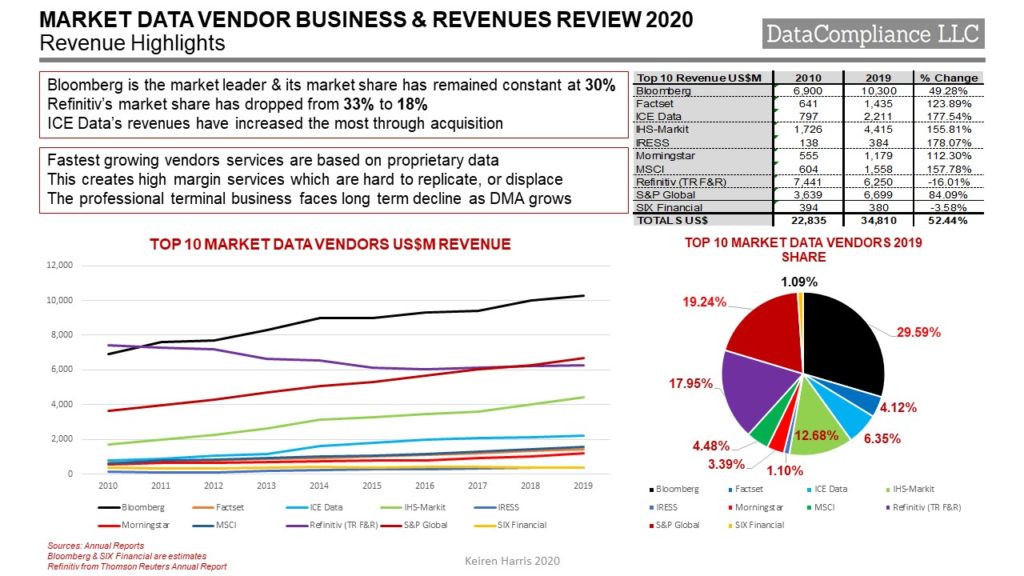

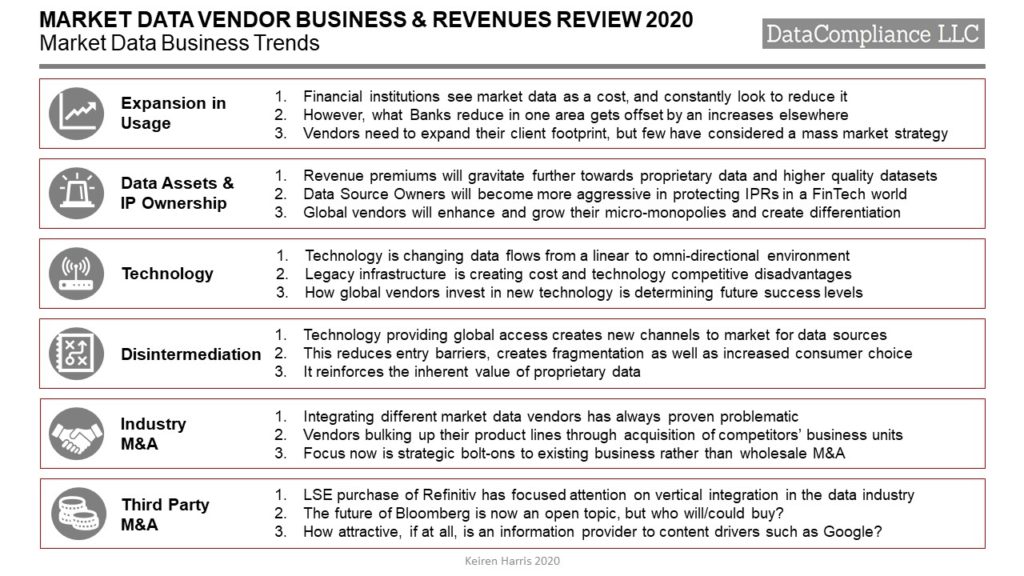

The Top 10 vendors estimated revenues for all business activities grew from in 2010 $22,835 Million to 2019 $34,810 Million, i.e. a growth rate of 52.4%

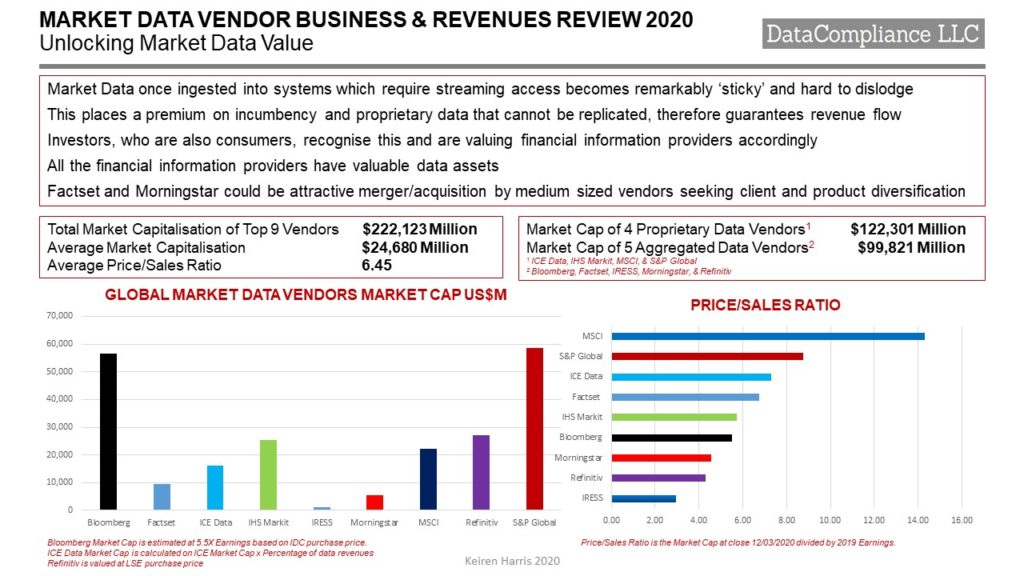

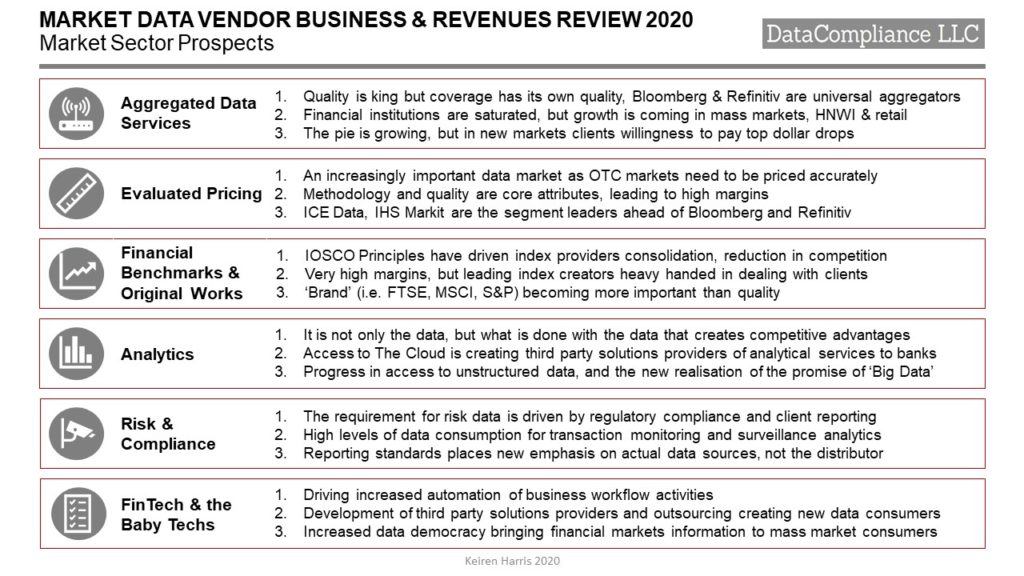

By Revenue, since 2010 the most successful providers of financial information and market data services are those whose core business services are providing proprietary data, such as Evaluated Pricing, Financial Benchmarks, Indices, Credit Markets and Analytics. This financial information providers group includes ICE Data, IHS Markit, MSCI, plus S&P Global.

During this period these vendors combined revenues grew from $6,766 Million to $14,882 Million in 2019, or 120%.

In contrast, vendors with a product suite built upon an aggregated model such as Bloomberg, Factset, IRESS, Morningstar, Refinitiv (ex Thomson Reuters F&R), and SIX Financial have seen significantly lower revenue growth. In fact both Refinitiv’s and SIX Financial’s revenues declined over the period.

By comparison, these vendors combined revenues grew from $16,070 Million to $19,928 Million in 2019, or 24%.

It is no accident that during this period all vendors have invested in developing proprietary services either organically, or through M&A in each of the market segments listed above. ICE Data is the classic example of a financial information provider that is successfully transitioning its strategy from aggregation to proprietary data services. This strategic shift from reliance upon aggregated data services also encompasses, Transaction Services, Risk & Compliance services, and RegTech.

Each vendor is identifying individual market growth niches, which is beginning to have competition implications, but unsurprisingly strategic focus varies amongst the 10 competitors.

All figures produced in this report are in US Dollars are based upon Bloomberg published FX rates on 12/03/2020

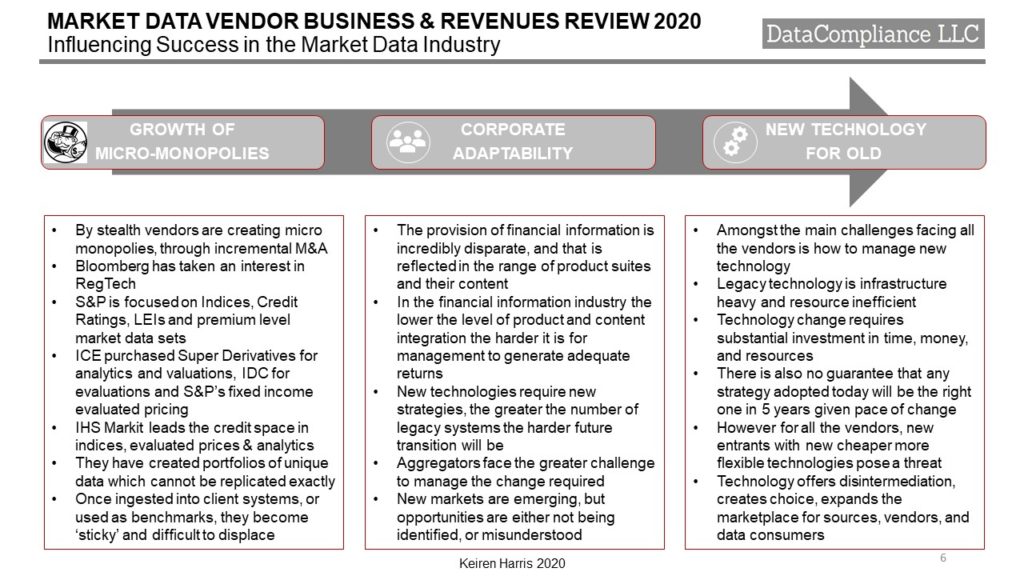

All these information providers face new challenges which need addressing, especially as they are all linked together

•The largest financial institutions are saturated with data, with 1 Bank claiming 40% of the data it receives goes either unused or gets wasted

•This shifts the data sourcing paradigm from aggregation to original data sources

•New technology and distribution channels threaten to disintermediate the aggregators, based on cost and accessibility

•Regulators are now focusing less on how data is being used to what data is being used, its provenance and purpose, the upcoming UK FCA consultative paper is a prime example

•Future growth will come from new markets, i.e. Solutions providers, HNWI, retail and informational distributors, however, these are not going to bring the same revenue premiums as the existing institutional client base

Impacts

•Ownership of original and unique data and focus on Intellectual Property drives value in the market •Lightweight technologies and data delivery mechanisms threaten to disintermediate vendors dependent upon mass aggregation of data, this will undermine existing pricing models

•Data driven solutions for FinTech, WealthTech, RegTech, InsurTech, and others are the future, but vendors do not seem to understand these markets and apply traditional (failing) business strategies to non-traditional data consumers

•Banks will increasingly switch data processing from in-house to specialist solutions providers, so relying on the data inputs and outputs only

•Regulators will likely propose licence regimes for market data providers Existing lengthy vendor contracts with onerous/unfair termination clauses will come under review pressure