Benchmarks Are Brands

Financial Benchmarks including indices have become so ubiquitous, they play such a fundamental role in the financial marketplace, yet their impacts to most observers are literally just the ‘tip of the iceberg’. Some of the things indices can do:

1. Indices benchmark markets, and subsets of those markets in terms of absolute performance and relative performance

2. Indices are used by funds to benchmark their performance against the market

3. Indices have increasingly been used as by portfolios as trackers where the components of an index are used as the portfolio components to the extent there are now more such ‘Passive Funds’ by value and volume, than there are actively managed funds (Yes these funds often still manage to under-perform the market???)

4. Indices create new tradable products for exchanges, such as Futures

5. Indices are used to create new derivative products for financial institutions such as ETFs, structured products, and for other tailored usage

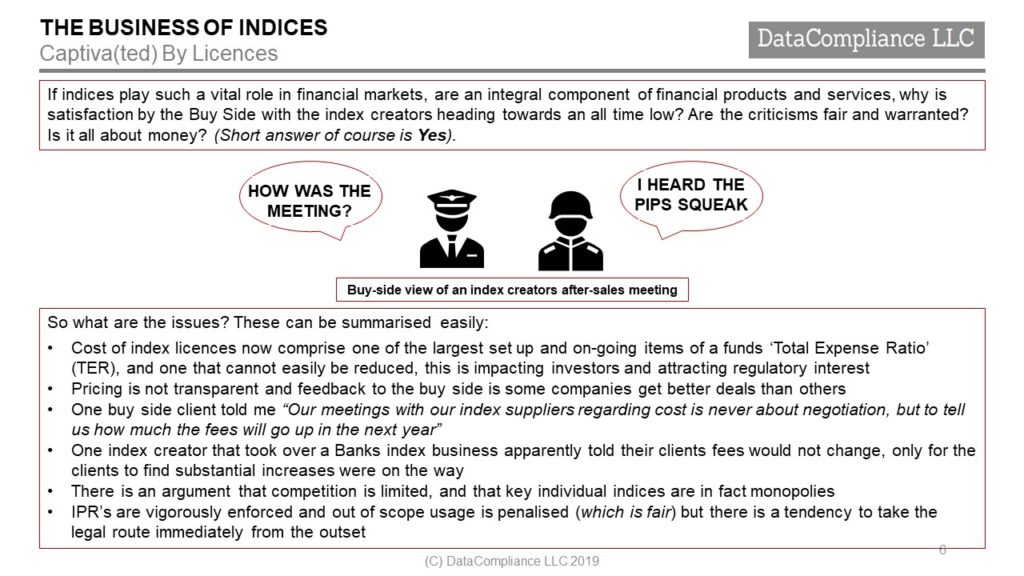

It is surprising the extent to which the index consumer becomes wedded to a ‘Brand’. A DJIA, S&P500, FTSE 100, Nikkei 225 MSCI Global can be replicated but not replaced. It is arguable that competition barely exists in the industry because key indicators are monopoly products, and that financial institutions find it easier to sell products linked to specific brands, then products linked to perhaps better indices but ones the market fails to recognise.

Once the index has embedded in the business it is going nowhere. The relationship becomes that of the terrorist and the hostage who fast develops ‘The Stockholm Syndrome’.

The index providers are more than aware of their products true value, leveraging this pedestal position either to sell out at a good profit, or maximise the revenue flows.

This makes index creation, IP ownership, high value, high margin, high profits.

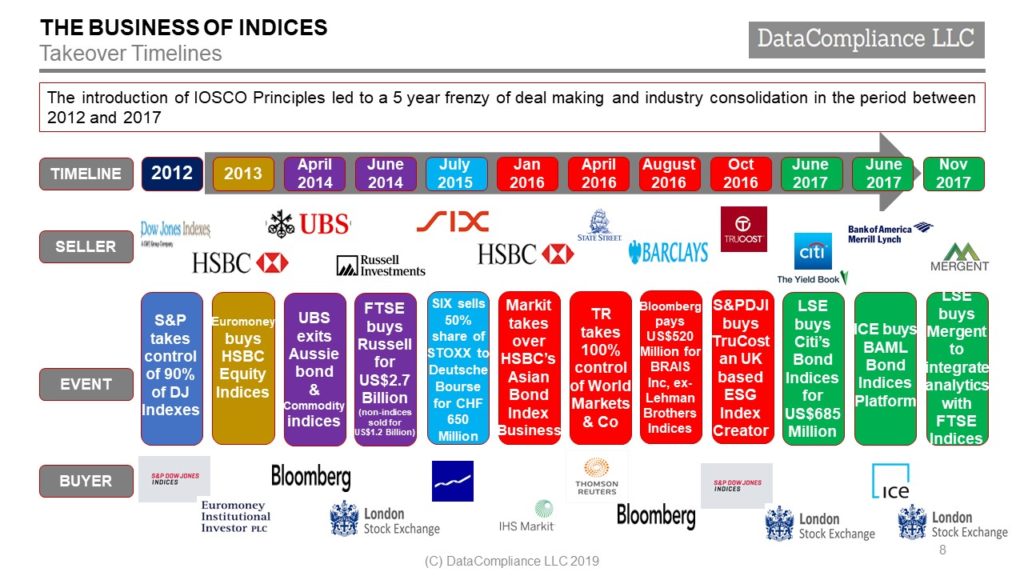

Takeover Impacts

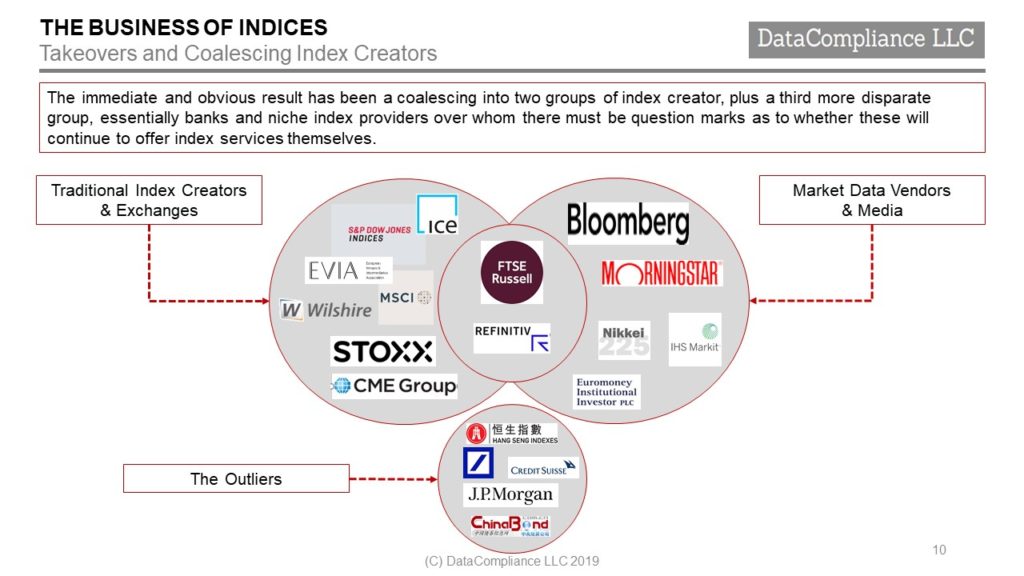

If we delve deeper into the deals, more signs can be divined.

• The traditional index creators long ago maximised their coverage of the exchange based markets, primarily equities •To build more equity linked coverage, specialisation is required, and enter stage right are the new (and high cost) ESG Indices

• To grow in terms of coverage they must venture bolder and deeper into the OTC markets •In the past, the OTC markets tended to be avoided and for good reason

• It has always proven difficult to get reliable and consistent data, and the Banks that could supply this data had their own index businesses, until recently

• The Banks exodus from the index creation business is an opportunity being seized by exchanges and market data vendors alike •IOSCO Principles has opened the door to wider index coverage of the OTC markets, especially in Fixed Income, and to a lesser extent, Commodities, and Energy by the traditional index creators

• IOSCO Principles have also improved transparency about how indices are created, can be trusted, and facilitating even greater index usage by promoting index quality

MSCI have been noticeably absent from the takeover fray.

Strangely, the index creators and the Inter-dealer brokers could never work out a deal, as this at least from the outside appears a logical match.

FTSE and ICAP explored a partnership only to founder at the very top levels of management. A little later when FTSE and Tullett Prebon discussed co-operating in Asia but this never managed to get off the ground

Into The Future

The future does look bright for indices and financial benchmarks in general, despite the issues raised by Buy Side firms. Their usage is increasing through broader coverage as well as deeper product offerings that cater to differentiation and specialisation.

What should we be looking out for?

• There is little opportunity for any major consolidation amongst the index providers for the foreseeable future

• However, index creators are already expanding their base offerings through the addition of analytics and other value added services. This trend will increase either through in-house development or purchase of specialist vendors

• It is unlikely the market data vendors will be able to take too much, if any, of the traditional index providers business away in their core areas of benchmarking exchange/equity indices •There will be greater competition outside this area, for instance in OTC markets, starting with Bond Indices as the buyers of the Fixed Income business of the Banks re-vamp and update the product offering on more commercial lines

• There will also be greater competition in the high margin ‘tailored’ index business, i.e. for General Funds, ETFs and Structured Products

• This could have a variable effect on costs to the consumers, there will be greater demand, partly owing to regulators, but there will be greater competition

• The market data vendors will struggle more to develop and grow their index businesses than the exchanges

• Currently regulators have other matters to deal with, however if complaints about pricing develop, they may be forced to investigate and introduce ‘guidelines’

Overall the future of indices and index usage looks bright and promising, the business of index creation though could be in for a shock, if the gap between the creators and the consumers continues to widen