One thing we know is data is created, and there can be multiple genesis stories as to how, and fortunately we (mostly) live in an age where heretics are not burnt at the stake. Though there was once a suggestion that Arthur Miller’s ‘The Crucible’s’ next re-enactment should be ultra-realistic with my participation as ‘one of the afflicted’.

But data does it exists, so the questions are “How is it created?”, ”Is it alive?”, and “If it is alive, what is its’ life cycle?”

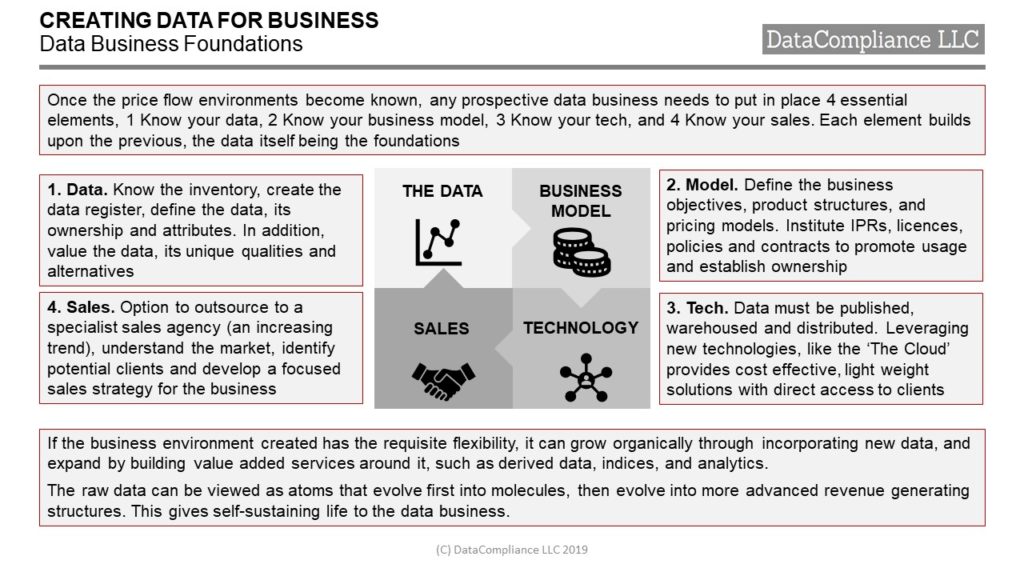

This paper is aimed at looking at how data is created in financial markets, its journey through life, and what it means for the data sources who own the Intellectual Property Rights (IP), and intend to create a business based on that data.

While we analyse how the process works in financial markets, as the most advanced industry in accessing, manipulating, and creating new data out of old data, the same principles do apply to Alternative Data, Commercial Data, or any other form of Primary Data.

By understanding data’s provenance and lineage, the value of data to its source owner and the data consumer can be derived.

What is required is to understand that data is the result of events, in series, with purpose.

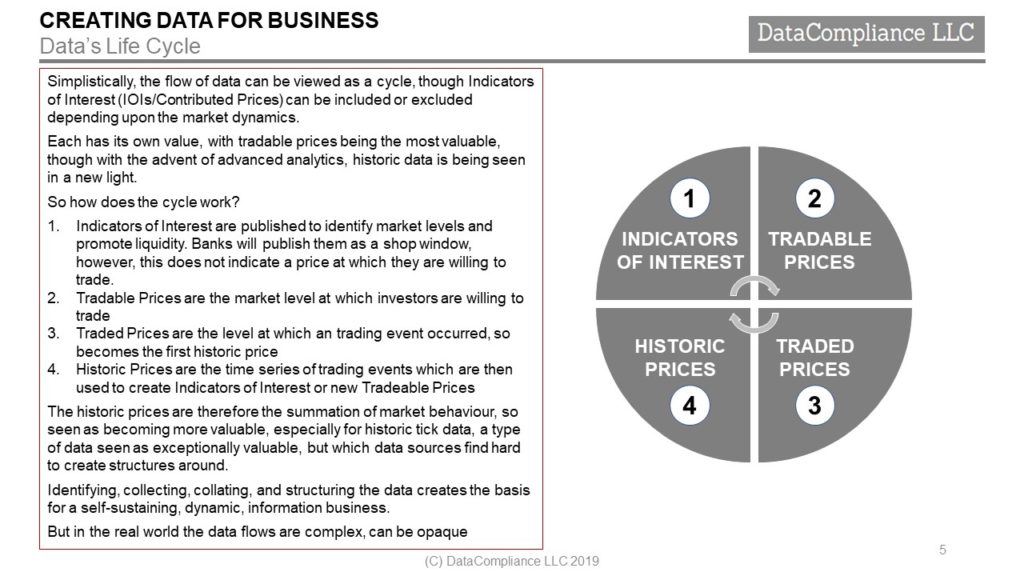

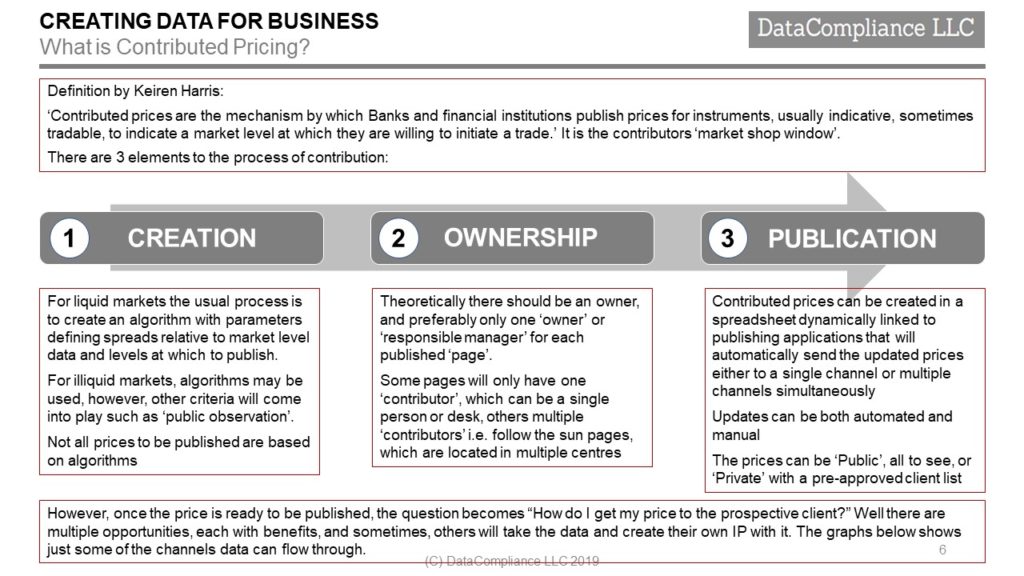

These events can take different forms, which can be educated guesses as to market levels, such as Indicators of Interest, or Contributed Pricing, or the preferred ‘Observable Transactions’, comprised of tradeable bid/offers, and traded pricing.

The difference between the two? •‘Indicators of Interest’ show what a market participant wants the market to trade at and therefore tries to establish market levels, and, •‘Observable Transactions’ which show what market participants will trade at, then did trade at

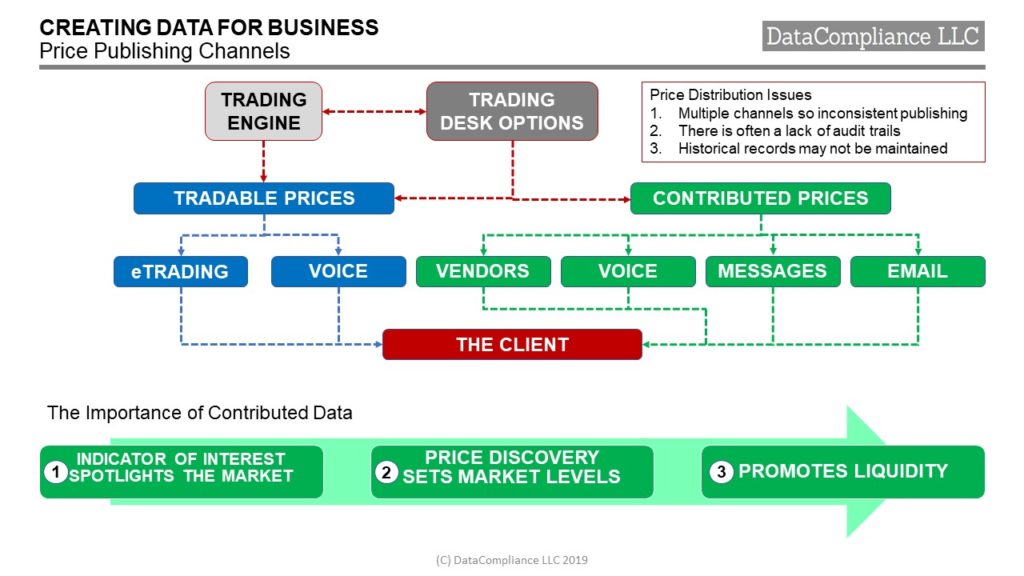

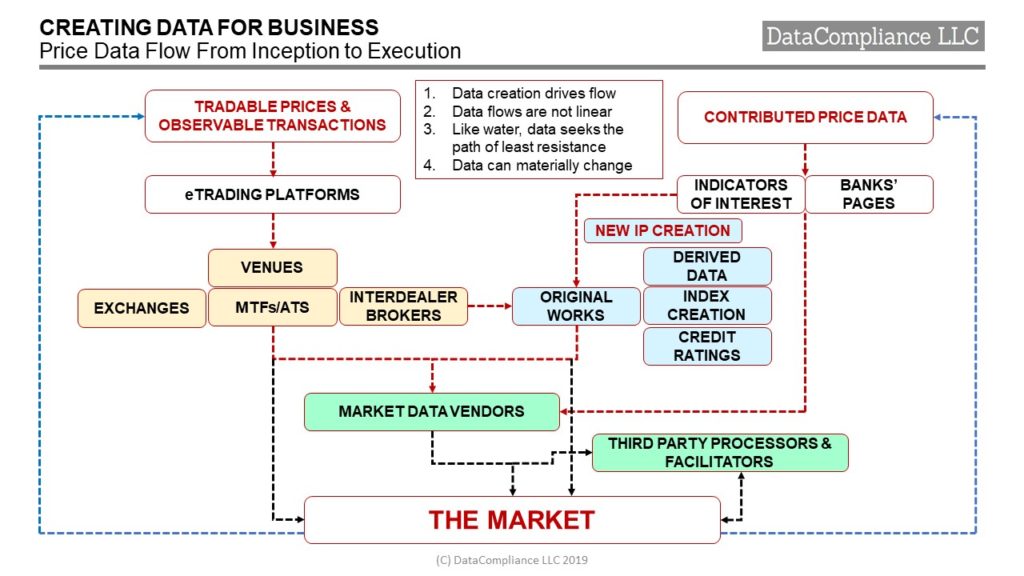

The questions do not cease, the data source still has to get its information to clients as efficiently as possible, and this is where things become more complicated, the data life cycle needs to be understood, because data from a trade creates new data. That data creates times series histories which can be analysed, and also turned into new data with an all new IP basis.

Data may be complex, and have the consistency of being intangible water, but when channelled in the right way brings material benefit to the source owner as well as the data consumer, because that data consumer is using that data as a revenue generating tool.