All Checked In & Can’t Check Out

Many existing large vendor contracts are monopolistic, anti-competitive, restrict choice, and prevent smaller more efficient vendors from competing by locking data consumers into unrealistic terms. There are a lot of good things in the contracts, especially relating to IPRs and usage rights, but there is also a lot wrong, and it hurts all parties, data consumers, data sources and the vendors themselves.

Existing contracts are proving to be barriers to a flourishing and vibrant market data industry, especially outside the traditional, and data saturated financial institutions.

It is commonplace to have 2, sometimes 3, year contracts with short notice periods often 60 to 90 days before rollover, some even longer at 6 to 12 months. While these contracts are in place there is little the customer can do to break out.

That customer is locked into the contractual Hotel California.

Business Strategy Impairment

This hurts the industry as well as the client who is unable to strategise effectively, or adapt to changing circumstances on the desk and around the business. 2 years is a long time in financial markets which can see asset classes crash, offices shut, and while the Banks can reduce headcount efficiently, they then find they are still having to pay for data that is not being used, and for long periods. Market Data can now be the third highest cost to a Bank.

Bloomberg to its credit, on its 2 year, 60 days notice, contracts does allow transfers, but this does require finding another contract to rollover, and this can happen because Bloomberg has individual contracts for services and terminals. In comparison, a smaller institution trying to find a way out of Refinitiv, and the other vendors which have based their contracts on Refinitiv’s (there are many), master sales agreement is in for a far tougher time. There are multiple side agreements and often it is difficult to say which services on the desk relate to which contracts because of inevitable staff and marketplace changes.

Monopolistic? Because once signed the only way out is to wait for the notice period to come around.

Anti-Competitive? Because during the contract there are no opportunities to displace the incumbent, and this means smaller vendors wishing to compete for business have to wait for the contract cycle to complete.

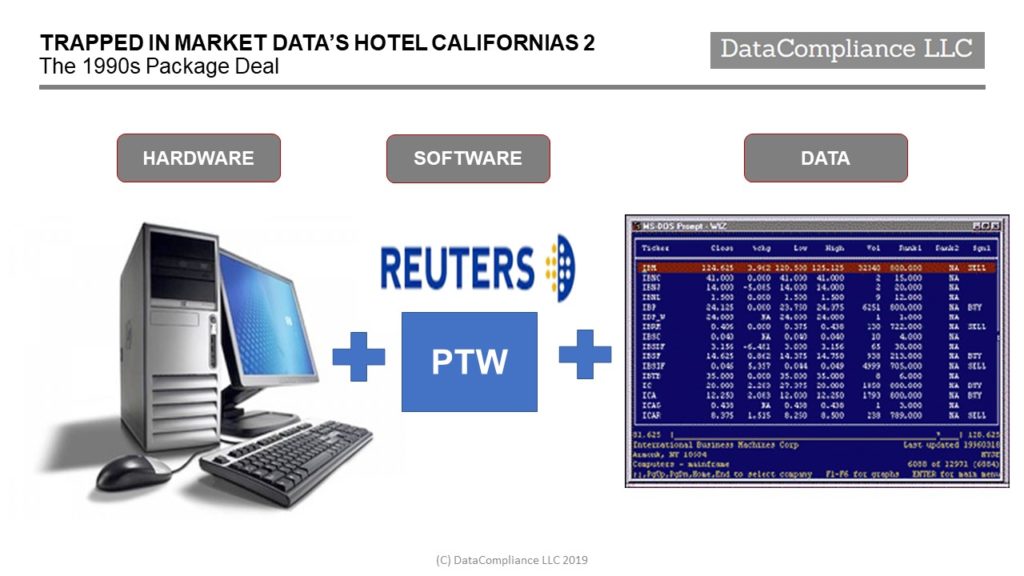

Genesis of the Market Data Contract

There was a genuine valid reason for the original contracts to develop as they did. Back in the 1980s and 1990s the vendors, Bloomberg, Telerate, Reuters and others supplied the hardware, software, plus the data bundled as a single package. Back then hardware was expensive, as late as 1997 according to 24/7 Wall Street, a Dell Dimension XPS H266 came at a price of US$3,979 (Inflation adjusted US$5,904) and that had nowhere near the performance of todays PC.

That meant the vendors had to invest significant monies into hardware which only had a limited lifespan, 2 year contracts were necessary to mitigate the costs.

Then as networked delivery became the norm, the Banks supplied their own PCs, the vendors did not have to buy PCs anymore, but the contracts did not change. Indeed Reuters then started charging for software licences (anyone remember ATW, PTW & RTW?) plus maintenance.

These days the vendors still need to have infrastructure in place, but at the front end, data is delivered as a datafeed to populate internal applications or displayed on what could, uncharitably, be described as glorified browsers.

The initial rationale for the types of contracts in place has gone.

A Fairer Contract to Encourage Investment in Market Data

The argument is these contracts hurt the vendors, as they disincentivise investment.

They prevent change from occurring, because as financial institutions become data saturated, data usage growth is coming from new types of players, including third party service facilitators & data processors, quasi-financial institutions, and especially wealth management. These are clients naturally reluctant to enter into lengthy agreements because they are cost sensitive, and more likely to ignore IPRs if contracts are unfavourable.

Therein lies the irony, smaller, market data vendors with lightweight technologies will have a competitive advantage in these new and exciting markets, precisely because they will offer contracts more fair, transparent, and suitable to these new types of data consumer.

The exchanges’ and even the index creators, contracts tend to be fairer in application because they are data focused rather than bound up by legacy infrastructure thinking, 1 year terms being the rule.

Base contracts should be initial 1 year contracts, which once completed then offers 60 days notice of termination at any time, or quarterly terminations, is fairer to the data consumer and will not work against the vendor.

Why?