Keiren Harris 21/01/2019

In the Real World

In 2018 the first, and major, trend DataCompliance saw was companies coming to us asking “How can we make money out of our data?” The second trend we saw was a fundamental lack of comprehension as to how the dynamics of turning their proprietary data into dollars works. There is this attitude “Oh, I have data, I can sell it and make lots of money!”

Well, making money out of data just does not work like that.

Like it or not, as the information revolution really starts to build momentum, companies, organisations, individuals must realise they are all in some fashion in the data game. This can be as producers (Sources), consumers, but mostly both sources and consumers.

In 2019 we expect an increasing number of businesses to consider then take the data business route, so this paper discusses what must be done.

As the financial world has realised, information, and data, is not only a powerful resource, it is a lucrative source of revenue both in its raw state and increasingly in even higher value added forms such as benchmarks (indices), and analytics which are able to predict behaviour by providing vital tools for business and investment decisions. This realisation has spread to other industries because new technologies like ‘The Cloud’ and ‘Big Data’ have opened doors to data that were previously shut.

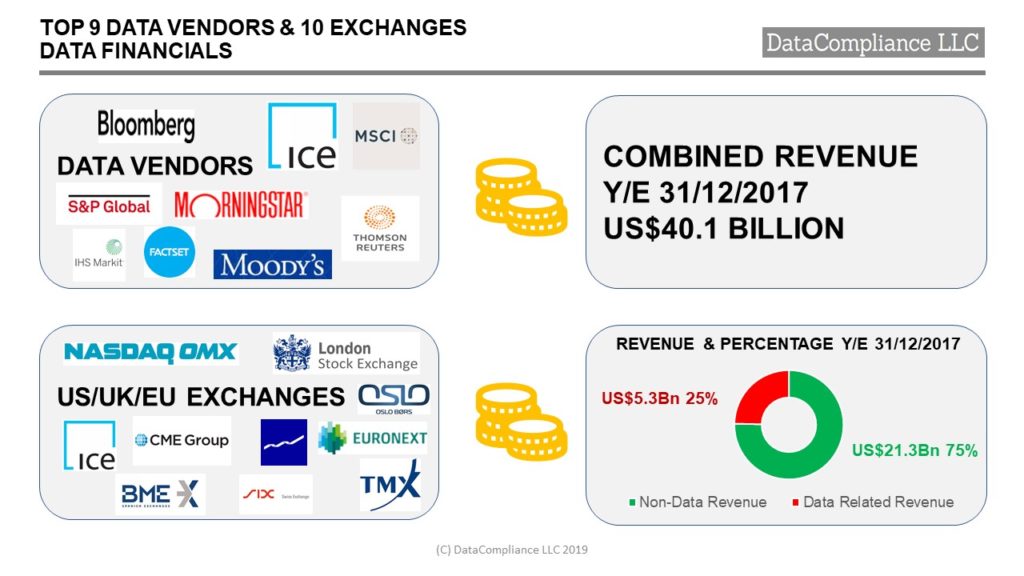

To place this into perspective, the top 9 market data vendors to financial markets had combined revenue of US$40.1 Billion in 2017. Again in 2017, the top 10 US, UK and European exchanges earned US$5.3 Billion from market data on total revenues of US$21.3 Billion (i.e. 25% and growing). InterContinental Exchange (ICE) alone generates 45% of its revenue from data related activities.

It is not unreasonable to expect the total market for data outside the financial industry to be far larger. The question is how to make dollars out of the data?

Understanding Basic Principles

There are 2 basic principles, the first is understanding how data functions, and the second is understanding ownership (i.e. Intellectual Property Rights, IPRs).

Principle 1. The Snickers Effect

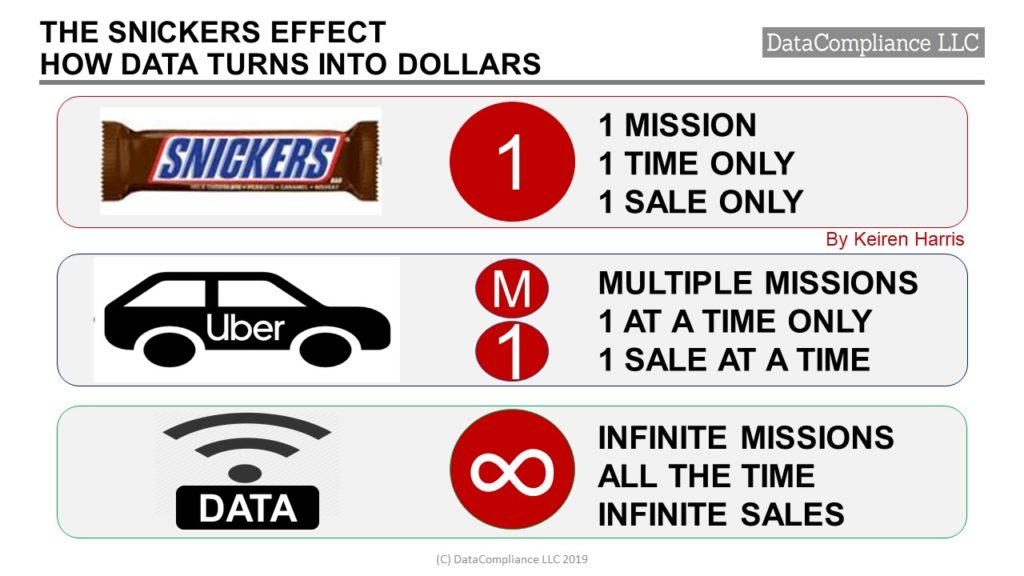

The Snickers Effect in essence demonstrates how data acts differently to other consumables because its only true limitations are accessibility, and naturally cost. What are the comparative differences?

- A Snickers bar is a delicious chocolate bar that serves one purpose, and once eaten that Snickers bar has gone, its mission has been completed.

- While a taxi driver can carry out multiple missions, he can only do one trip at a time.

- Contrast that with the ephemeral item of data, it can be used for an infinite number of missions, all at the same time, and all the time, by an infinite number of entities.

This ubiquity creates data’s intrinsic value to the source owner, because that owner can charge not only for access to the data, but importantly also how that data is, and can be, used.

The exact same item of data can therefore be ‘sold’ (licensed) to the same user for multiple different uses, and at the same time also to an infinite number of other users. This is how data turns into dollars.

However, and this is what data sources new to the business often fail to understand, is the value of the data is dependent upon who is using the data and for what purpose.

Data dollars need a reason to exist. Data which is valuable to one person, can have little to no immediate value whatsoever to another. For instance, the businessman owning a taxi firm in Los Angeles is unlikely to be buying data on Chocolate sales in Switzerland. That businessman wants continuous updated data on the number of journeys being made in LA, the associated demographics, fees, costs, and competitors market share.

The key words are continuous, and updated. Stale data is no dollar data, which places critical onus on getting the latest data to the client quickly and accurately.

It is this requirement to provide data flows that underpins how revenue is created, the data is not sold, it is sold for use under a licence. There is no transfer of ownership from the data source to the data user, except when the data users create new original data, and even then, a licence is usually required. The common mistake of equating software licences with data licences usually comes into play at this point.

Principle 2. Establish Ownership (IPRs)

This is where data gets messy. Data sources need to establish and enforce their ownership rights all along the data flow from beginning to the ultimate end user. This flow can encompass multiple players which aggregate data from other sources who in turn distribute data to other aggregators and increasingly third party facilitators which process data on an out-sourced basis.

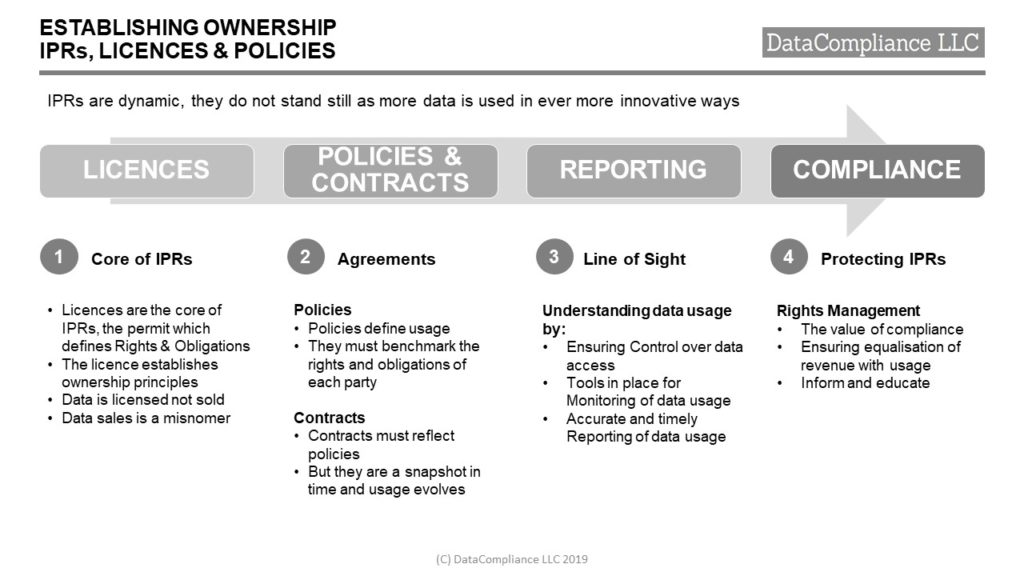

This means a legal framework must be formulated to establish ownership, and this is founded upon 4 legs:

- Developing licences for usage, the core of IPRs, it is the permit which defines rights and obligations, establishing ownership

- Policies and agreements informing clients what they can and cannot do

- Reporting structures to create an audit trail of usage and by whom, over what period, complete with effective tools to ensure control, monitoring and accurate reporting of data usage

- Compliance. Protecting and policing IPRs. Clients can and do use data out of scope.

As data usage grows, and evolves, clients find ever more innovative ways to use data. In contrast licences are not dynamic, they need to be updated on a regular basis. This means each iteration must be flexible enough to anticipate potential new distribution channels and the new types of data consumer that are appearing. Some of these players may have little respect for ownership rights, while others can be openly antagonistic.

Creating a Successful Data Business

The process to make money out of proprietary data is not difficult, the problem lies in understanding what is required from the process and putting it in place.

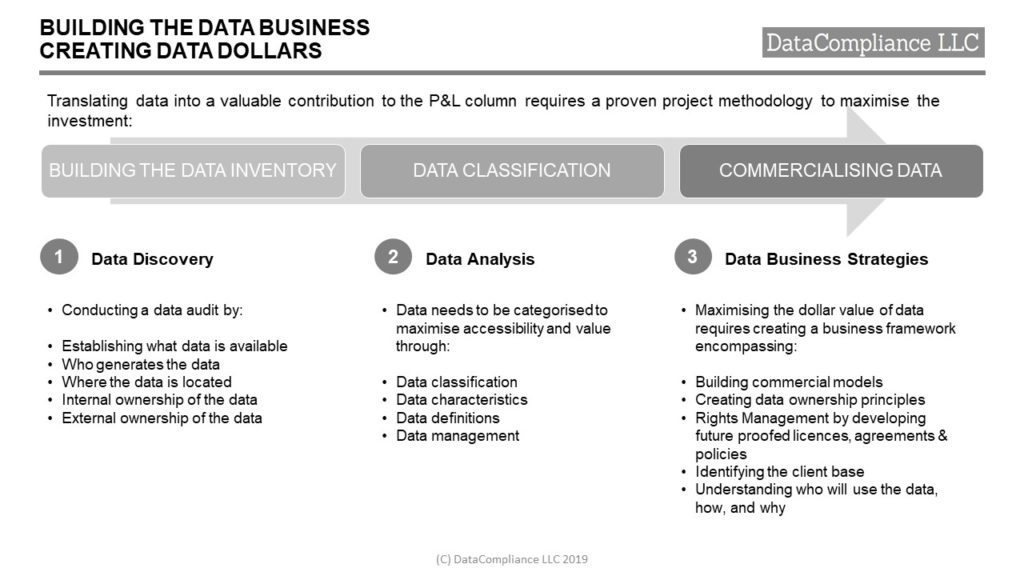

There are 3 initial building blocks that need to be put in place:

- Discovering what data is available, its attributes, functions, and purpose. This includes understanding the data’s provenance.

- Classifying and putting in place systems for management of the data, including internal ownership.

- Creating viable commercial models, backed by usage policies and licence agreements, based around knowing who the clients are, how they are going to use the data and why.

Once those building blocks are there, the strategic questions orient towards how to reach the clients leveraging available, and even better, future technology. New technologies, those great enablers of data, are breaking down barriers, and expanding market horizons. Successful data commercial strategies must factor in the way data can be stored, distributed, accessed, sorted, parsed, analysed, and adapted.

As this is a big subject in its own right, we will return to this critical subject.

Is Turning Your Data into Dollars Worth it?

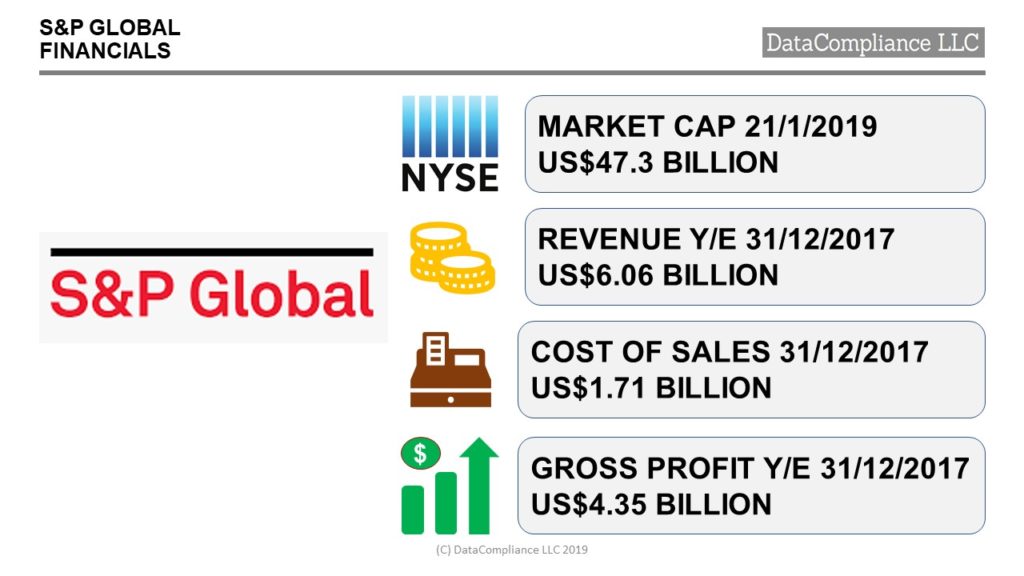

The margins on data can be high, a successful example of a company built upon original works IPRs is S&P Global (NYSE:SPGI). The financials speak for themselves.

The data business is a natural by-product of existing functionality built upon infrastructure created as a function of the underlying business that creates the data. This reduces the cost of establishment as well as providing an observable source. Costs come in the form of resourcing the business.

Question. Is turning your data into dollars worth it?

Answer. Yes, when the business is founded upon sound principles rather than wishful thinking.

About DataCompliance LLC

We specialise in data business, and our consultants have a proven track in advising on building data businesses, data utilisation, data Intellectual Property Rights, and data compliance. Please find us at www.datacompliancellc.com or visit the blog at www.marketdata.guru.